THE NEW WAY FORWARD

Experian and Fairtile launch a partnership on alternative credit scoring

Experian, global leader in consumer and business credit reporting and marketing services, and Fairtile, financial technology startup that develops a modern hybrid multi-cloud platform for Credit Intelligence and Automation services, have created a partnership for Alternative Credit Scoring solutions.

The partnership will enable Experian and Fairtile to pair their experiences, methodologies and technologies to codevelop a new unique solution combining Traditional and Alternative Credit Scorings. With the increased use of credit in today's marketplace, our industry will remain an important part of consumers' financial lives.

- “ We're excited about our partnership with Fairtile; we can now offer to our customers an easy access to broader opportunities through an innovative partner.Alessandro Cirinei

Commercial Strategy Director | Experian - “ Fairtile's mission is to enable a fair credit experience to Lenders and Borrowers. We're proud to partner with Experian to help give access to new world class credit scoring solutions.Cristiano A. Motto

Co-Founder and Director | FAIRTILE

LANDSCAPE AND CHALLENGES

The digital era requires a Credit's paradigm shift

Credit is the engine of the world, but we need a paradigm shift to bypass the inefficiencies of the current model.

With the Covid-19 pandemic stressing individuals and businesses resilience, financial inclusion continues to be a key global challenge.

Demographic changes are driving significant shifts in customer expectations and behaviours. New business models are required to serve digital native, unbanked and under-banked populations.

For lenders to success, it is imperative to increase volumes and keep risk under control while sustaining compliance.

- 2.1 Bn

Global Unbanked Population - 2.1

Global Underserved Population - 40%

Digital Native Borrowers

OUR SOLUTION

We enable a new ways to evaluate creditworthiness

We help lenders to use new kinds of data to evaluate borrowers and we help borrowers to unlock the power of their data to enable financial inclusion. Traditional credit scores are still the core to take decisions for the majority of portfolio but cannot apply to everyone, especially for unbanked like migrants, students, freelancers. Moreover traditional solutions have shown to be weak when have to evaluate the new digital native generations. Give a fairer treatment to the great customers of the future with an alternative approach is now mainstream.

Brochure

Operational Systems

Integrate key data-points captured by lenders during the acquisition process.

Digital Services

Leverage personal data like open banking, social media and streaming services.

Device Data

Capture valuable device data such as vendor name, price, age and more.

Digital Footprints

Intercept customers digital footprints like IP addresses, connection types and more.

Contact Centers

Transform voice and text interactions in a source for new customers profiling.

Digital Documents

Elaborate digital documents uploaded by the borrower as bills, contracts, payrolls and rents.

HOW IT WORKS

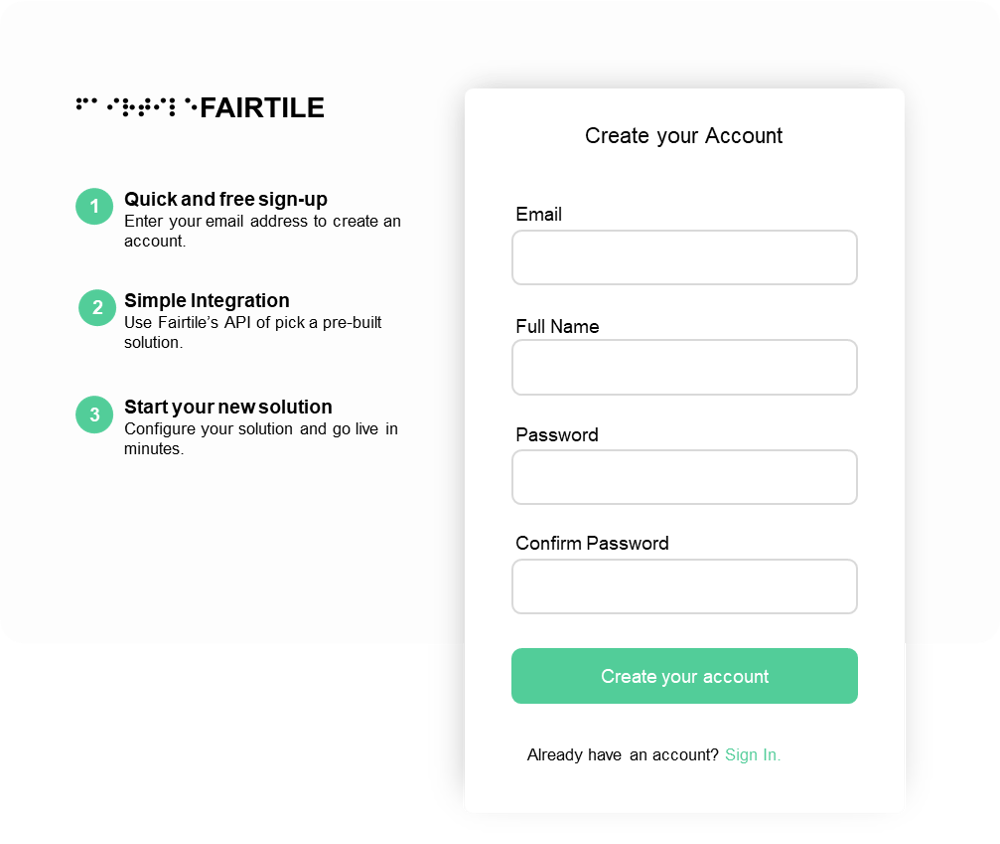

We offer a seamless integration in three easy and quick steps

DHS OUTCOMES

A set of outcomes designed by our credit risk experts

Instant Credit Scoring

We have created algorithms combining Digital Footprints, Human Science and Artificial Intelligence. We don't just make conclusions based on the interplay of a few historical financial statistics of the consumer. We take a deeper look at the persons, their character, their mood, their social interactions and determine a personal profile towards financial relationships.

Underwriting Insights

Underwriting involves making decisions that are high-impact yet complex in nature. The majority of the time, however, underwriters are too busy trying to search, access, aggregate and understand information to gain real insights that can assist with decision-making. We provide a set of key data to help them making reliable and profitable decisions for the organization.

Identity Verification

Our Identity Verification helps companies improve conversion rates, comply with AML and KYC regulations and better detect fraud while delivering a definitive yes/no decision in seconds. We access a wide range of data sources and analyse structured and unstructured data using AI to make the process of identifying high-risk clients and enhance due diligence processes.

Affordability Calculator

We offer a fully digital experience for loan applications through our automated income and expenses calculator. AI engines leverage PSD2 & Open Banking data combined with a wide set of digital footprints and information extracted from digital sources to automatically classifies incomes and expenses and use them to calculate the borrower's affordability.

DEPLOYMENT OPTIONS

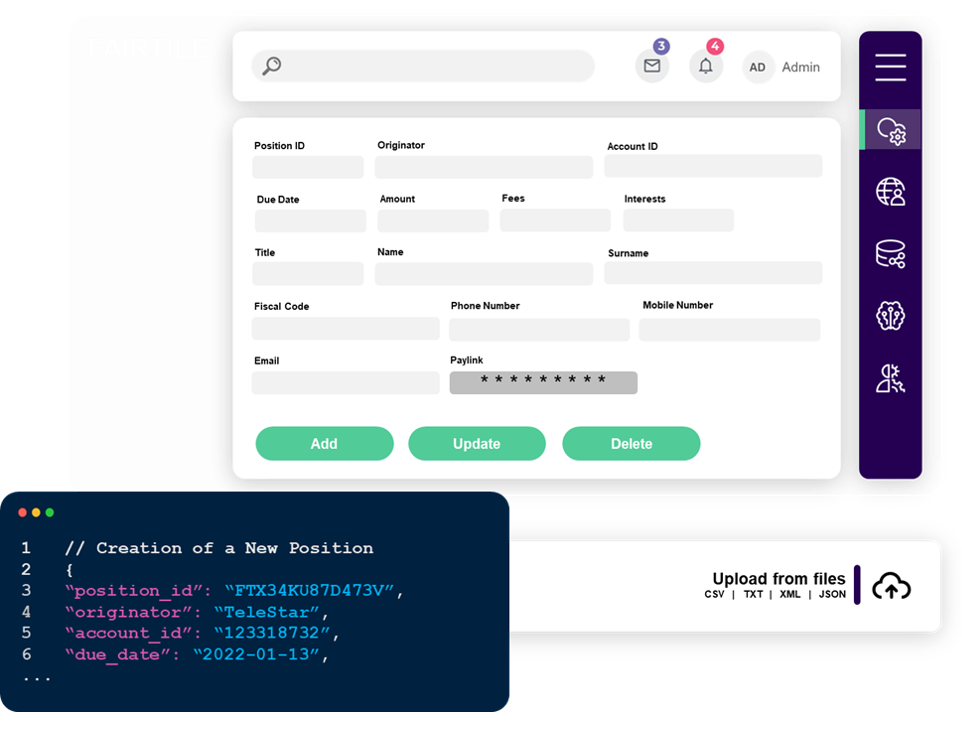

Enjoy a Seamless Integration using our modular interfaces

SDKs

SDKs

The SDKs provides an easy access to our REST APIs and fast development of our customers systems. Widgets

Widgets

Our white label widgets can be integrated into Lenders app either by redirecting to a URL or embedding an iframe. Hosted Pages

Hosted Pages

Our Hosted Pages are the best way to set up our customers services in few hours. We host the entire solution for them.

MAKE THINGS HAPPEN

Improve your acquisition processes with our outcomes, Now!

Leverage the power of our solution to improve your underwriting process, acquire more customers and reduce your credit risk.

FAIRTILE's Digital Human Scoring is the only solution that unlocks more revenues and savings, connecting thousands of contextual and behavioral data points, from all the main type of sources in the market, to build a unique creditworthiness' profile of your customers. We help you to serve more borrowers through the creation of a world-class "Alternative Credit Scoring" solution.

Book a demo