We use cookies and similar technologies that are necessary to operate the website. Additional cookies are only used with your consent.

We use the additional cookies to perform analyses of website usage and to check marketing measures for their efficiency. These analyses are carried out to provide you with a better user experience on the website.

You are free to give, deny, or withdraw your consent at any time by using the "cookie settings" link at the bottom of each page. You can consent to our use of cookies by clicking "Agree".

For more information about what information is collected and how it is shared with our partners, please read our Data Protection Statement.

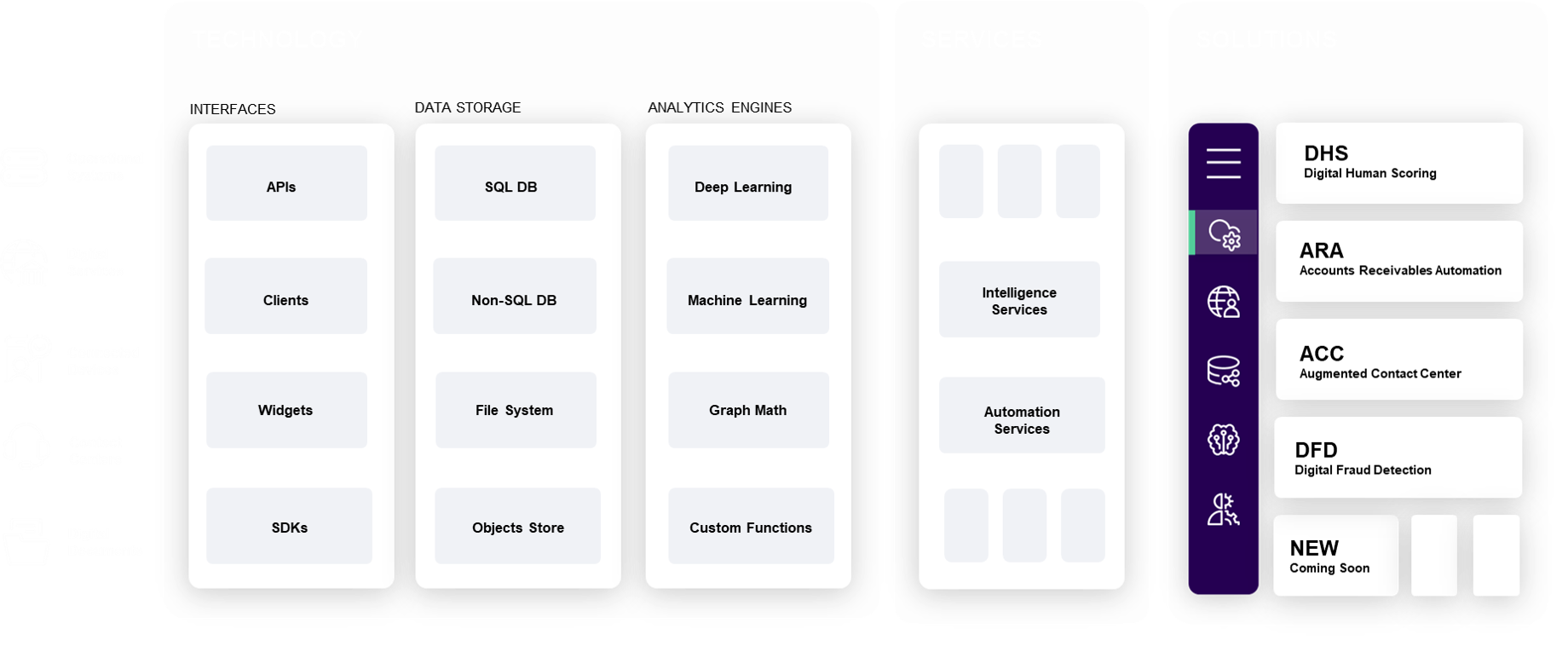

Proprietary interfaces with Clients, SDK, APIs and Widgets

Proprietary interfaces with Clients, SDK, APIs and Widgets Proprietary Business Data Models and Feature Store

Proprietary Business Data Models and Feature Store Proprietary AI Engines and Business Ontologies

Proprietary AI Engines and Business Ontologies Proprietary Human Science and Risk Management Models

Proprietary Human Science and Risk Management Models

We know exactly what your organization needs right now.

We know exactly what your organization needs right now. We always work together with our customers to improve our solutions.

We always work together with our customers to improve our solutions. We do not delivery just solutions. We inspire a paradigm shift.

We do not delivery just solutions. We inspire a paradigm shift.