LANDSCAPE AND CHALLENGES

Protect your business and growth by stopping frauds

Susceptibility to fraud and financial crime is inherent in automation and digitalisation,

and increased online transaction volumes and massive financial networks across numerous

global locations only make risk and fraud management harder.

Cybercrime and malicious hacking have grown over the past few years.

Organizations are constantly exposed to external threats and internal mismanagement in various ways.

To combat these threats, they have heavily invested time and resources to combat fraud and financial crimes.

Advanced software play a vital role in this process and oversee, recognise, and report fraudulent activity

within all industries and sectors.

But the stakes are high. Fraud management costs, data privacy breaches, and damage to brand reputation

all demand that enterprises stay ahead in the fight to monitor suspicious activities in real time,

establish transparent reporting capabilities, and track compliance and audit goals.

- +95%

Scams growth in 2020 - 5%

Account Takeover traffic - USD 260 Bn

Fraud Losses 2021-2025

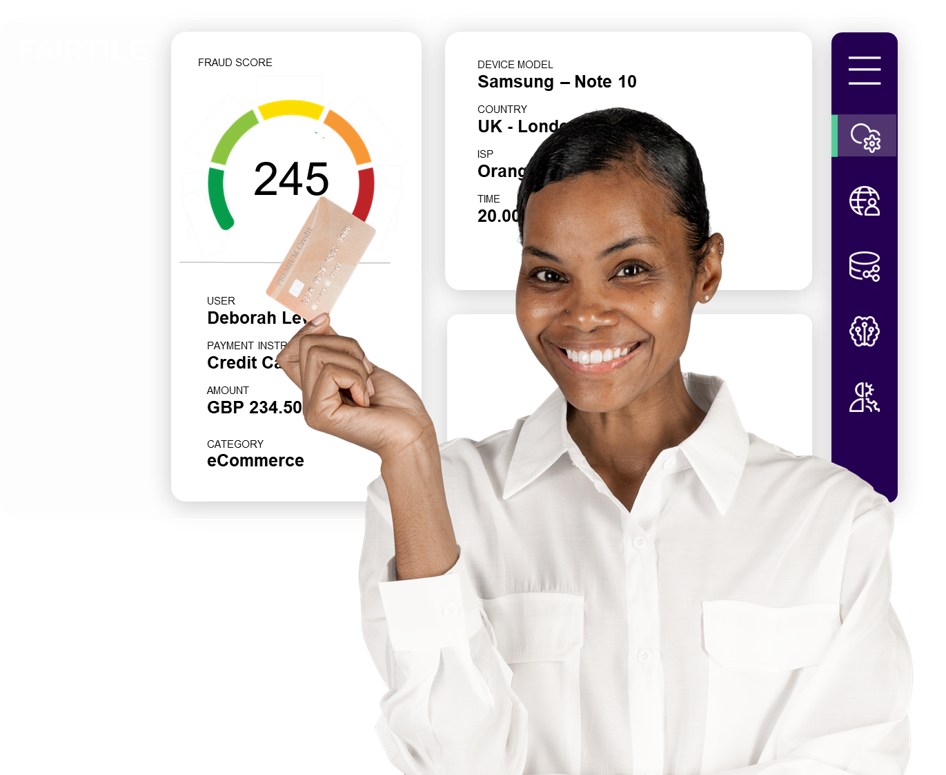

OUR SOLUTION

We use AI and Graphs to protect our customers

Fighting fraud is incredibly important for every organization. With the enhancement in technology, fraudsters come up with new fraud techniques and strategies. Hence, organizations should come up with new techniques and strategies to prevent fraud as well. Graph technologies and AI are the way to detect and prevent fraud. Thanks to graph analytics, connections between people, bank accounts, phones, locations, etc. can be analysed easily to highlight suspicious activities.

Brochure

Syntetic Identity

Verify the consistency if thousand of identity data points in real time to detect anomalies.

Account Takeover

Use behavioural profiling to verify every single transaction and historical information in real time.

Fraud Rings

Connect customers, transactions, devices and more to discover fraudolest activities.

Risk Based Authentication

Score every transaction at the origination to protect your customers accounts.

HOW IT WORKS

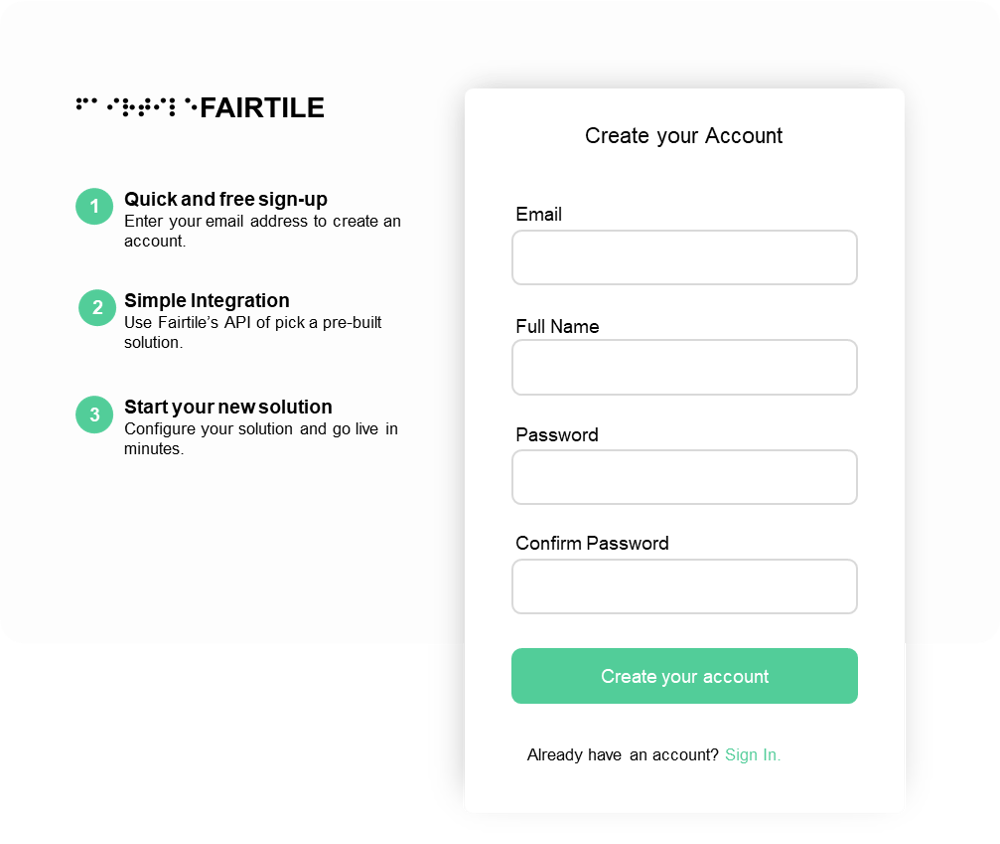

We offer a seamless integration in three easy and quick steps

DFD OUTCOMES

A set of outcomes designed by our experts in partnership with leading Financial Institutions

Fraud ScoreOur fraud scoring engine help you make smart, consistent choices about whether to accept or reject a transaction. Humans cannot compete with computers when it comes to data interrogation. That's why artificial intelligence holds so much potential – because it presents the opportunity to analyse and act on patterns too complex for the human brain to even identify.

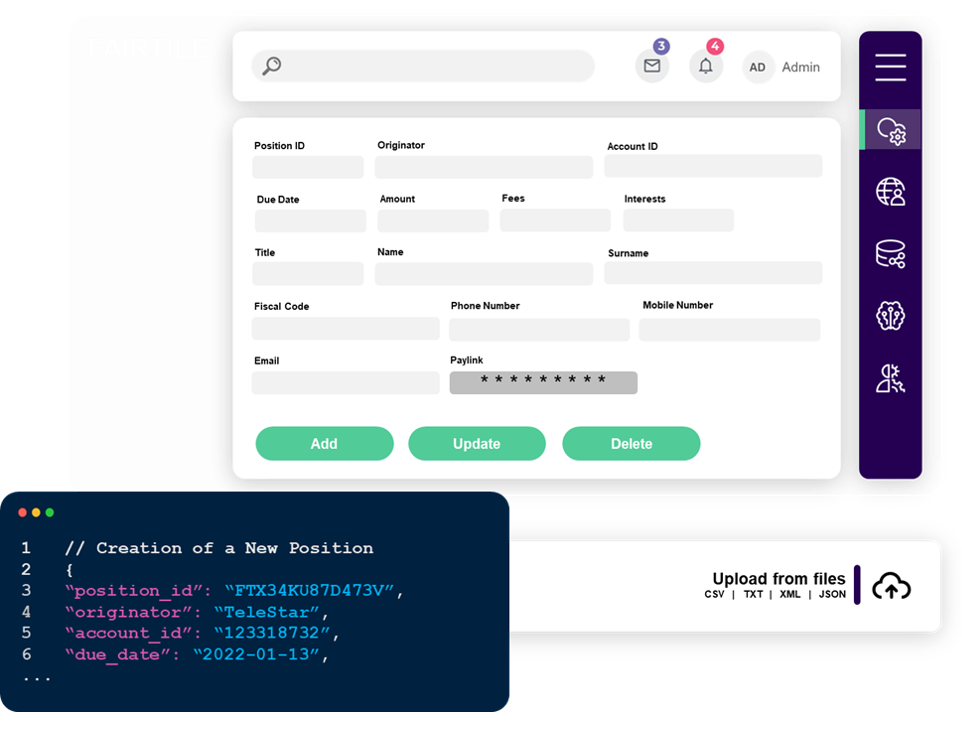

Business Entities GraphOur Graph Data Model augments existing fraud detection capabilities to combat a variety of financial crimes including first-party bank fraud, credit card fraud, ecommerce fraud, insurance fraud and money laundering – and all in real time.Traditional databases allow you to see blocks of facts - but if you want to find out how they're connected, you need to work harder to do some analysis. Graph DBs make this easier.

DEPLOYMENT OPTIONS

Enjoy a Seamless Integration using our modular interfaces

SDKs

SDKs

The SDKs provides an easy access to our Platform and fast development of our customers systems. Clients

Clients

Our white label clients can be integrated into customers app with a minimum impact in term of resources and time. Hosted Components

Hosted Components

Our Hosted Components are the best way to set up our customers services in few hours. We host the entire solution for them.

MAKE THINGS HAPPEN

Improve your fraud prevention processes with our outcomes, Now!

Leverage the power of our solution to improve your fraud management. Analise, classify, control and score every transaction.

FAIRTILE's Digital Fraud Detection is an innovative solution that combine and contextualise transactions and interactions, connecting thousands of data points, to build a unique picture of every activity. We help you to increase your success rate in prevent and detect frauds while serving your customers better with the creation of a world-class hyper-personalized customer experience.

Book a demo